History of the Central Bank of Brazil

The establishment of the Brazilian Central Bank is the result of a maturation process. Before the beginning of the 20th century, there was growing awareness in the country that it was necessary to create a "bank of banks" with power to issue paper money and perform the role of State banker.

The need for a financial institution to organize the Brazilian monetary system can be traced back to 1694, when the Brazilian Mint 1 was founded. In 1808, when Portugal's Prince-Regent Dom João VI arrived in colonial Brazil, the idea of creating a bank with the duties of a central and a commercial bank was already underway. The Bank of Brazil 2 was created the same year, in order to cope with this gap.

The Bank of Brazil was originally set up with mixed responsibilities. As a Central Bank, it performed the roles of depositary, discount and issuing bank. In addition, it was responsible for selling the exclusive products of the State administration and Royal contracts. This dual role performed by the Bank of Brazil is seen as one of the factors that explains why it took so long before a true Central Bank was established.

After a few years, it became apparent that it was necessary to develop a system that would enable the country to keep up with the world's economic and financial development.

However, there was no institution to control the money supply up to 1945. All duties of monetary authority were carried out by the Bank of Brazil. Mr. Getúlio Vargas, the President at that time, issued Decree 7,293 3 establishing the Superintendency for the Currency and Credit - SUMOC 4. This institution was assigned the task of controlling the disorganized financial market, fighting inflation, as well as preparing the establishment of a Central Bank.

SUMOC had to carry out several duties: to set reserve requirements for commercial banks; to stipulate the discount rate and the rate for financial assistance in case of insufficient liquidity; as well as to determine interest rates for bank deposits. In addition, it supervised the activities of commercial banks, steered the foreign exchange policy, and represented the country before international institutions.

In the meantime, the Bank of Brazil acted as a government's bank: controlling foreign trade; receiving mandatory and voluntary deposits from commercial banks; performing foreign exchange trades; and acting on behalf of public enterprises and the National Treasury 5. These activities were subject to the norms imposed by SUMOC and the Bank of Agricultural, Commercial and Industrial Credit 6.

Meanwhile, the National Treasury issued paper money - a complex process encompassing several governmental entities. It is also noteworthy that federal budget management and other fiscal activities were performed by the Ministry of Finance, the Central Bank of Brazil and the Bank of Brazil.

In December 1964, Law 4,595 7 was passed, establishing the Central Bank of Brazil 8 as a federal agency, part of the National Financial System. The Central Bank began its activities in March, 1965 because article 65 stated that Law 4,595 would come into effect 90 days after publication.

With the creation of the Central Bank of Brazil, legal mechanisms were outlined to allow the institution to act as a “bank of banks”. In 1985-1986 the reorganization of government finances redefined accounts and responsibilities between the Central Bank of Brazil, Bank of Brazil and a redesigned National Treasury 9 in order to take gradually the control of all the federal budget and fiscal financing matters. In 1986 the Special Account 10 was abolished and the money supply from the Central Bank to the Bank of Brazil began to be clearly identified in the budgets of both institutions, thus eliminating automatic transfers.

The reorganization of government finances advanced up to 1988, when the responsibilities that are typical of monetary authorities were progressively transferred from the Bank of Brazil to the Central Bank. The atypical activities performed by the Central Bank were transferred to the National Treasury, such as those related to fostering initiatives and the management of the federal public debt.

The 1988 Constitution granted important rules regarding the activities of the Central Bank, as the exclusive delegation to issue money on behalf of the Union. In order to approve the President's nominee for the positions of Deputy Governor or Governor of the Central Bank the Constitution stipulated the need for a public hearing, and a secret vote in the Senate. Furthermore, the Constitution prohibited the Central Bank to grant direct or indirectly loans to the National Treasury.

Under article 192, the 1988 Constitution also mandated the need for a complementary law concerning the National Financial System, intended to substitute Law 4,595 and to redefine duties and organization of the Central Bank.

At that time, there was an attempt to group all departments of the Central Bank in a single headquarters, but when the 1967 Constitution and Decree 60,871 12 went into force, the historical course of the institution changed. This decree determined that all the personnel had to be transferred to the country's capital.

Initially the Central Bank was meant to be built in an area located at the North banking district donated by Brasilia's local government in October 1967.

The massive transfer of employees was discarded, pursuant to Law 5,363 15 of November 30, 1967, which addressed the transfer of “core units of the federal administration”, and by virtue of the Central Bank's decentralization process. The first unit to operate in Brasília was a section of the Legal Department. In January 1969, an additional section subordinated to the Governor's office began to operate.

In March 1970, during President Medici's administration, after direct recommendations of the President of the Republic, it was established that the transfer would occur in two phases: the Directorate and their respective offices would be operating in the capital city by July of that year and the remaining sectors by December, with the exception of the Guanabara Regional Office.

The first meeting of the Board of Governors of the Central Bank was held in Brasília in September 1970.

For some time, the administration looked for a prime site, in terms of location and size, to construct the building. Although the Central Bank owned a lot in SBN district, the institution purchased another in SBS district 16, near Bank of Brazil's headquarters, considering to construct there a twenty-story building for 970 employees.

In August 1972, NOVACAP 17 proposed an exchange of lots which was accepted by the Central Bank. As a result, lot 32 was chosen as the site for construction of the future Central Bank's headquarters. In November 1973, the Central Bank and NOVACAP signed an agreement to open a selection of architects in order to design the building. The winning project would be awarded a prize, however none of the proposals met the needs of the Bank. In August 1974, the administration bought from BNH 18 the lot 33, located in the vicinity of SBS. The previously chosen lot 32 was swapped with Bank of Brazil for residential areas in Plano Piloto 19.

Before the construction was finished, the Central Bank operated in twelve different areas across the city. Employees were distributed in six buildings in the area of SCS 20 and two others in the SBN. The Board of Governors occupied two floors in the Bank of Brazil. Three other workplaces were located in the Industrial Sector 21. The warehouse had housed the printing services, and today keeps temporary and historical files. Bank employees worked in two buildings: the majority at the Palace of Agriculture 22, located at the SBN, and the rest at Vera Cruz building, situated in the SCS, home to one Directorate, the data processing department, and the first data processing center.

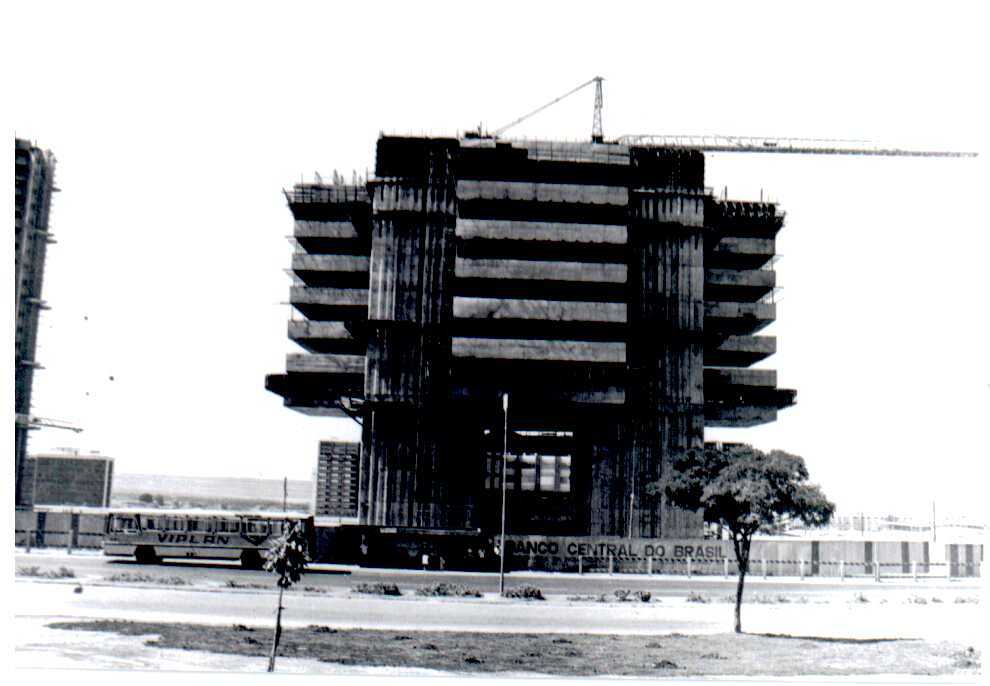

The main building of the Central Bank, inaugurated in 1981, reflects the evolution of the Brazilian economy like no other in recent decades, marked by monetary stability and inflation control. It is widely recognized throughout the country as the symbol of a respected institution, nationally and internationally. The landmark is visible from anywhere in the city and is one of the most important monuments among the buildings in the architectural set of Brasilia.

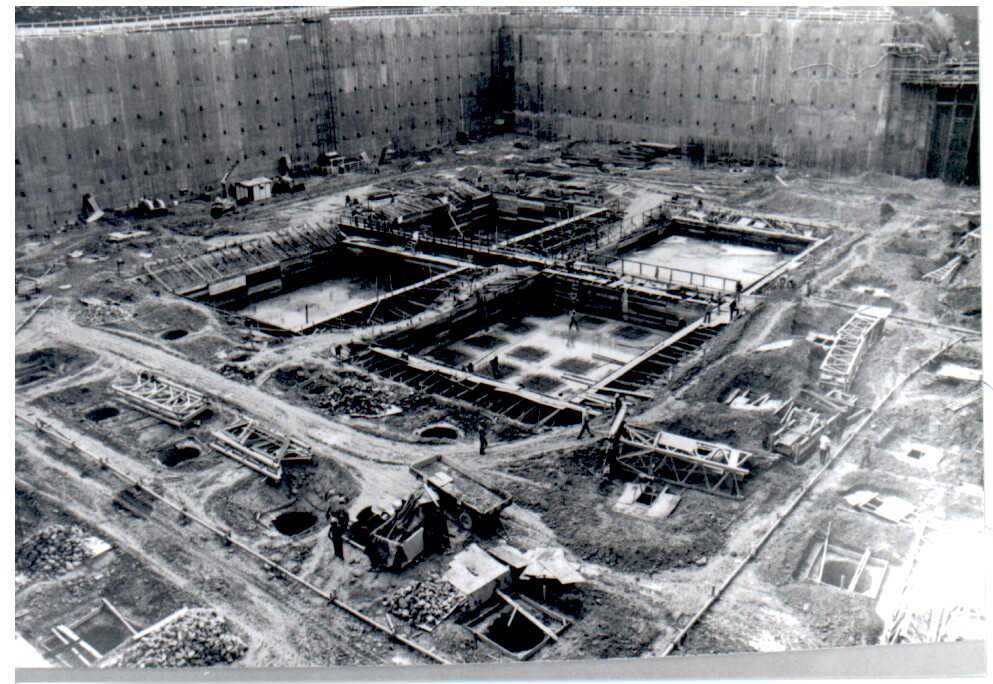

The design was conceived by Mr. Hélio Ferreira Pinto's architecture firm. Construction work began on August 11, 1975, and ended on May 20, 1981. The Brazilian engineers employed innovative techniques of construction. The project was so intricate that the Central Bank held three bids: one for the excavation of the foundation, one for preparing the anchored retaining wall and one for the construction itself.

The doubloon of the Brazilian Empire was a source inspiration for the architectural design. The architect modified the Cross of Christ 23, which is engraved on that coin, making the edges of its arms more straight – this originated the building outline. The idea for the towers forming elevator halls derives from the four corners of the cross. The Central Bank logo was conceived at the same time by Mr. Aloísio Magalhães, a designer member of the team. Although the building was still a model, the logo was inspired by the aerial view of the building's projected shadow.

The doubloon of the Brazilian Empire was a source inspiration for the architectural design. The architect modified the Cross of Christ 23, which is engraved on that coin, making the edges of its arms more straight – this originated the building outline. The idea for the towers forming elevator halls derives from the four corners of the cross. The Central Bank logo was conceived at the same time by Mr. Aloísio Magalhães, a designer member of the team. Although the building was still a model, the logo was inspired by the aerial view of the building's projected shadow.

--------------------

Notes

1- Portuguese: Casa da Moeda.

2- Portuguese: Banco do Brasil. Acronym: BB.

3- Decree 7,293 (in Portuguese)

4- Portuguese: Superintendência da Moeda e do Crédito. Acronym: SUMOC.

5- Portuguese: Tesouro Nacional.

6- Portuguese: Banco de Crédito Agrícola, Comercial e Industrial.

7- Law 4,595 (in Portuguese).

8- Portuguese: Banco Central do Brasil. Acronyms: BC, BCB, BACEN.

9- Portuguese: Secretaria do Tesouro Nacional (acronym: STN), as a part of the Ministry of Finance.

10- Account used for liquidation among financial institutions.

11- See details on the Amortization Office. Portuguese: Caixa de Amortização.

12- Decree 60,871 (in Portuguese).

13- Brazilian capital city.

14- 1967 Constitution (in Portuguese).

15- Law 5,363 (in Portuguese).

16- Brasília's two major banking districts: North banking sector, Portuguese: Setor Bancário Norte – SBN and South banking sector, Portuguese: Setor Bancário Sul – SBS.

17- Brasília's construction agency. Portuguese: Companhia Urbanizadora da Nova Capital. Acronym: NOVACAP.

18- The National Bank for Housing. Portuguese: Banco Nacional da Habitação.

19- Brasília's central area.

20- Brasília's South commercial area. Portuguese: Setor Comercial Sul.

21- Brasília's South industrial area. Portuguese: Setor de Indústria e Abastecimento.

22- Portuguese: Palácio da Agricultura.

23- The heraldic sign of Portuguese Order of Christ. Portuguese: Cruz de Cristo.

--------------------

Photo Credits

Top to bottom.

a- Construction of the main building of the Central Bank. Acervo do Banco Central.

b- Amortization Office building, 1906. Arquivo Nacional.

c- Construction of the main building of the Central Bank (3 pictures). Acervo do Banco Central.

d- Doubloon. Acervo do Banco Central.

The need for a financial institution to organize the Brazilian monetary system can be traced back to 1694, when the Brazilian Mint 1 was founded. In 1808, when Portugal's Prince-Regent Dom João VI arrived in colonial Brazil, the idea of creating a bank with the duties of a central and a commercial bank was already underway. The Bank of Brazil 2 was created the same year, in order to cope with this gap.

The Bank of Brazil was originally set up with mixed responsibilities. As a Central Bank, it performed the roles of depositary, discount and issuing bank. In addition, it was responsible for selling the exclusive products of the State administration and Royal contracts. This dual role performed by the Bank of Brazil is seen as one of the factors that explains why it took so long before a true Central Bank was established.

After a few years, it became apparent that it was necessary to develop a system that would enable the country to keep up with the world's economic and financial development.

However, there was no institution to control the money supply up to 1945. All duties of monetary authority were carried out by the Bank of Brazil. Mr. Getúlio Vargas, the President at that time, issued Decree 7,293 3 establishing the Superintendency for the Currency and Credit - SUMOC 4. This institution was assigned the task of controlling the disorganized financial market, fighting inflation, as well as preparing the establishment of a Central Bank.

SUMOC had to carry out several duties: to set reserve requirements for commercial banks; to stipulate the discount rate and the rate for financial assistance in case of insufficient liquidity; as well as to determine interest rates for bank deposits. In addition, it supervised the activities of commercial banks, steered the foreign exchange policy, and represented the country before international institutions.

In the meantime, the Bank of Brazil acted as a government's bank: controlling foreign trade; receiving mandatory and voluntary deposits from commercial banks; performing foreign exchange trades; and acting on behalf of public enterprises and the National Treasury 5. These activities were subject to the norms imposed by SUMOC and the Bank of Agricultural, Commercial and Industrial Credit 6.

Meanwhile, the National Treasury issued paper money - a complex process encompassing several governmental entities. It is also noteworthy that federal budget management and other fiscal activities were performed by the Ministry of Finance, the Central Bank of Brazil and the Bank of Brazil.

In December 1964, Law 4,595 7 was passed, establishing the Central Bank of Brazil 8 as a federal agency, part of the National Financial System. The Central Bank began its activities in March, 1965 because article 65 stated that Law 4,595 would come into effect 90 days after publication.

With the creation of the Central Bank of Brazil, legal mechanisms were outlined to allow the institution to act as a “bank of banks”. In 1985-1986 the reorganization of government finances redefined accounts and responsibilities between the Central Bank of Brazil, Bank of Brazil and a redesigned National Treasury 9 in order to take gradually the control of all the federal budget and fiscal financing matters. In 1986 the Special Account 10 was abolished and the money supply from the Central Bank to the Bank of Brazil began to be clearly identified in the budgets of both institutions, thus eliminating automatic transfers.

The reorganization of government finances advanced up to 1988, when the responsibilities that are typical of monetary authorities were progressively transferred from the Bank of Brazil to the Central Bank. The atypical activities performed by the Central Bank were transferred to the National Treasury, such as those related to fostering initiatives and the management of the federal public debt.

The 1988 Constitution granted important rules regarding the activities of the Central Bank, as the exclusive delegation to issue money on behalf of the Union. In order to approve the President's nominee for the positions of Deputy Governor or Governor of the Central Bank the Constitution stipulated the need for a public hearing, and a secret vote in the Senate. Furthermore, the Constitution prohibited the Central Bank to grant direct or indirectly loans to the National Treasury.

Under article 192, the 1988 Constitution also mandated the need for a complementary law concerning the National Financial System, intended to substitute Law 4,595 and to redefine duties and organization of the Central Bank.

Back to the first years in Rio de Janeiro

All employees of the Central Bank were expected to be gathered at a single building, previously belonging to the Amortization Office 11. However, right after the establishment of the Central Bank, the administration was distributed over more than ten different addresses throughout the city.At that time, there was an attempt to group all departments of the Central Bank in a single headquarters, but when the 1967 Constitution and Decree 60,871 12 went into force, the historical course of the institution changed. This decree determined that all the personnel had to be transferred to the country's capital.

The first years in Brasília

In June 1967, a task force was appointed to plan the transfer of Central Bank headquarters to Brasília 13, in accordance with articles 2 and 183 of the 1967 Constitution 14.Article 2. The Federal District is the Union's capital.

Article 183. Within one hundred and eighty days from the enactment of this Constitution the Executive Power shall propose a bill to Congress in order to rule the completion of the transfer of the federal organs which remained on the Guanabara state to the Union's capital.

Article 183. Within one hundred and eighty days from the enactment of this Constitution the Executive Power shall propose a bill to Congress in order to rule the completion of the transfer of the federal organs which remained on the Guanabara state to the Union's capital.

Initially the Central Bank was meant to be built in an area located at the North banking district donated by Brasilia's local government in October 1967.

The massive transfer of employees was discarded, pursuant to Law 5,363 15 of November 30, 1967, which addressed the transfer of “core units of the federal administration”, and by virtue of the Central Bank's decentralization process. The first unit to operate in Brasília was a section of the Legal Department. In January 1969, an additional section subordinated to the Governor's office began to operate.

In March 1970, during President Medici's administration, after direct recommendations of the President of the Republic, it was established that the transfer would occur in two phases: the Directorate and their respective offices would be operating in the capital city by July of that year and the remaining sectors by December, with the exception of the Guanabara Regional Office.

The first meeting of the Board of Governors of the Central Bank was held in Brasília in September 1970.

For some time, the administration looked for a prime site, in terms of location and size, to construct the building. Although the Central Bank owned a lot in SBN district, the institution purchased another in SBS district 16, near Bank of Brazil's headquarters, considering to construct there a twenty-story building for 970 employees.

In August 1972, NOVACAP 17 proposed an exchange of lots which was accepted by the Central Bank. As a result, lot 32 was chosen as the site for construction of the future Central Bank's headquarters. In November 1973, the Central Bank and NOVACAP signed an agreement to open a selection of architects in order to design the building. The winning project would be awarded a prize, however none of the proposals met the needs of the Bank. In August 1974, the administration bought from BNH 18 the lot 33, located in the vicinity of SBS. The previously chosen lot 32 was swapped with Bank of Brazil for residential areas in Plano Piloto 19.

Before the construction was finished, the Central Bank operated in twelve different areas across the city. Employees were distributed in six buildings in the area of SCS 20 and two others in the SBN. The Board of Governors occupied two floors in the Bank of Brazil. Three other workplaces were located in the Industrial Sector 21. The warehouse had housed the printing services, and today keeps temporary and historical files. Bank employees worked in two buildings: the majority at the Palace of Agriculture 22, located at the SBN, and the rest at Vera Cruz building, situated in the SCS, home to one Directorate, the data processing department, and the first data processing center.

Construction of the Main Building

|

|

|

The main building of the Central Bank, inaugurated in 1981, reflects the evolution of the Brazilian economy like no other in recent decades, marked by monetary stability and inflation control. It is widely recognized throughout the country as the symbol of a respected institution, nationally and internationally. The landmark is visible from anywhere in the city and is one of the most important monuments among the buildings in the architectural set of Brasilia.

The design was conceived by Mr. Hélio Ferreira Pinto's architecture firm. Construction work began on August 11, 1975, and ended on May 20, 1981. The Brazilian engineers employed innovative techniques of construction. The project was so intricate that the Central Bank held three bids: one for the excavation of the foundation, one for preparing the anchored retaining wall and one for the construction itself.

The building outline

The doubloon of the Brazilian Empire was a source inspiration for the architectural design. The architect modified the Cross of Christ 23, which is engraved on that coin, making the edges of its arms more straight – this originated the building outline. The idea for the towers forming elevator halls derives from the four corners of the cross. The Central Bank logo was conceived at the same time by Mr. Aloísio Magalhães, a designer member of the team. Although the building was still a model, the logo was inspired by the aerial view of the building's projected shadow.

The doubloon of the Brazilian Empire was a source inspiration for the architectural design. The architect modified the Cross of Christ 23, which is engraved on that coin, making the edges of its arms more straight – this originated the building outline. The idea for the towers forming elevator halls derives from the four corners of the cross. The Central Bank logo was conceived at the same time by Mr. Aloísio Magalhães, a designer member of the team. Although the building was still a model, the logo was inspired by the aerial view of the building's projected shadow.Curiosities

- Four administrations were in office during the almost 6-year period of the Bank's construction: Mr. Paulo H. Pereira Lira, Mr. Carlos Brandão, Mr. Ernane Galvêas and Mr. Carlos Langoni. The latter was in office at the time of the building's inauguration.

- The building was officially occupied in September 1981, but Governor Carlos Langoni and Deputy Governors had already been working there for a year and a half before the inauguration.

- The Central Bank contracted an American company with expertise in Central Bank planning. The firm provided technical information on security, values handling and communication for the project.

- The floor area available on the building's upper levels is smaller than that on the ground level. The six floors below street level cover the entire area of the lot, approximately 10,000 square meters. The 21 floors above street level cover an area of about 1,800 square meters.

Learn more

The following sources about the Central Bank's history are available in Portuguese:

- Banco Central do Brasil, CPDOC/FGV. 1990. Octávio Gouvêa de Bulhões: Depoimento. Brasília: Banco Central do Brasil.

- Banco Central do Brasil, CPDOC/FGV. 1993. Denio Nogueira: Depoimento. Brasília: Banco Central do Brasil.

- Lago, P.A.C. 1982. A Sumoc como embrião do Banco Central: sua influência na condução da política econômica, 1945-1965. Rio de Janeiro: PUC-Rio. Available from: www.econ.puc-rio.br/pdf/tese/pedrolago.pdf [May 7, 2014].

- Figueiredo Filho, J. S. 2005. Políticas Monetária, Cambial e Bancária no Brasil sob a gestão do Conselho da Sumoc, de 1945 a 1955. Rio de Janeiro: UFF. Available from: www.bcb.gov.br/pre/Historia/HistoriaBC/2005-joao_sidney.pdf [May 7, 2014].

--------------------

Notes

1- Portuguese: Casa da Moeda.

2- Portuguese: Banco do Brasil. Acronym: BB.

3- Decree 7,293 (in Portuguese)

4- Portuguese: Superintendência da Moeda e do Crédito. Acronym: SUMOC.

5- Portuguese: Tesouro Nacional.

6- Portuguese: Banco de Crédito Agrícola, Comercial e Industrial.

7- Law 4,595 (in Portuguese).

8- Portuguese: Banco Central do Brasil. Acronyms: BC, BCB, BACEN.

9- Portuguese: Secretaria do Tesouro Nacional (acronym: STN), as a part of the Ministry of Finance.

10- Account used for liquidation among financial institutions.

11- See details on the Amortization Office. Portuguese: Caixa de Amortização.

12- Decree 60,871 (in Portuguese).

13- Brazilian capital city.

14- 1967 Constitution (in Portuguese).

15- Law 5,363 (in Portuguese).

16- Brasília's two major banking districts: North banking sector, Portuguese: Setor Bancário Norte – SBN and South banking sector, Portuguese: Setor Bancário Sul – SBS.

17- Brasília's construction agency. Portuguese: Companhia Urbanizadora da Nova Capital. Acronym: NOVACAP.

18- The National Bank for Housing. Portuguese: Banco Nacional da Habitação.

19- Brasília's central area.

20- Brasília's South commercial area. Portuguese: Setor Comercial Sul.

21- Brasília's South industrial area. Portuguese: Setor de Indústria e Abastecimento.

22- Portuguese: Palácio da Agricultura.

23- The heraldic sign of Portuguese Order of Christ. Portuguese: Cruz de Cristo.

--------------------

Photo Credits

Top to bottom.

a- Construction of the main building of the Central Bank. Acervo do Banco Central.

b- Amortization Office building, 1906. Arquivo Nacional.

c- Construction of the main building of the Central Bank (3 pictures). Acervo do Banco Central.

d- Doubloon. Acervo do Banco Central.